Malaysia Population Research Hub

As populations grow and migrate, largely driven by urbanization to seek better employment opportunities, one of the increasingly challenging issue is to address the sustainable development of cities and the liveability of the population that reside in it. Liveability refers to the living environment from the perspective of the individual, which also includes a subjective evaluation of the quality of the housing conditions. A city revolves around its people, and the range of peoples needs in a city is broad, encompassing livelihood requirements of nourishment, housing and safety, education and vocational opportunities, recreational outlets and access to culture and arts. Getting a city to invest, develop, evolve and, ultimately, be a better host for its permanent residents, will propel it to become more sustainable and competitive.

In 2015, 74% of Malaysia population live in urban areas and is forecasted to grow to 80% in 2030, compared to just 56% in 1995. The rapid urbanisation has made housing increasingly unaffordable for Malaysian families. Affordability is well-defined by the relationship between household income and housing expenditure.

According to the report “Making Housing Affordable by Khazanah Research Institute, the overall Malaysian housing market is very unaffordable.

Using the “median-multiple ratio standard by the United Nations Centre for Human Settlement at the World Bank, a housing market is considered “affordable if the house price to median annual household income ratio is less than 3.0 times.

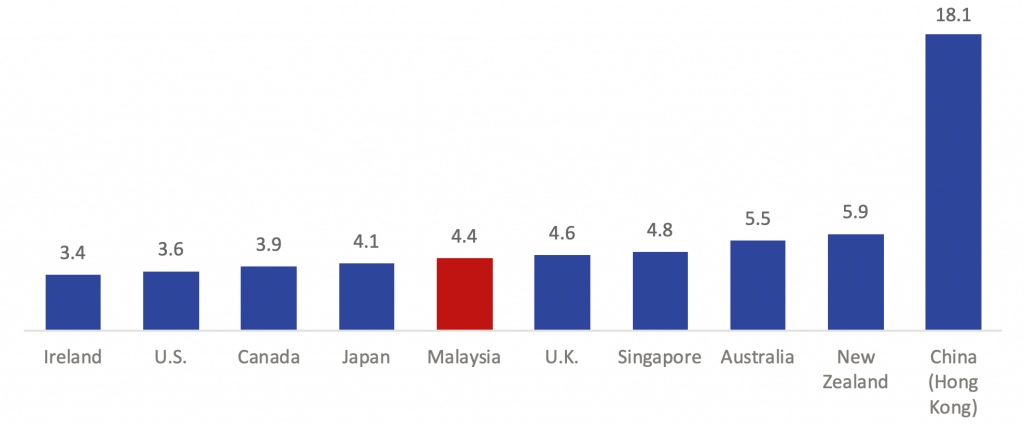

As the median annual income of Malaysians is around RM55,000 in 2014, this suggests that houses priced up to RM165,000 are considered affordable to a median Malaysian household. However, it was found that the overall Malaysian median-multiple in 2014 was 4.4 times.

Overall, houses in Malaysia are more unaffordable compared to developed countries such as Ireland (3.4), U.S. (3.6), Canada (3.9) and Japan (4.1) with lower median multiples, and is only slightly better than U.K. and Singapore (4.8).

Median-multiple by country

Source: Performance Urban Planning, 2017, Data for Malaysia sourced from Khazanah Research Institute, 2015

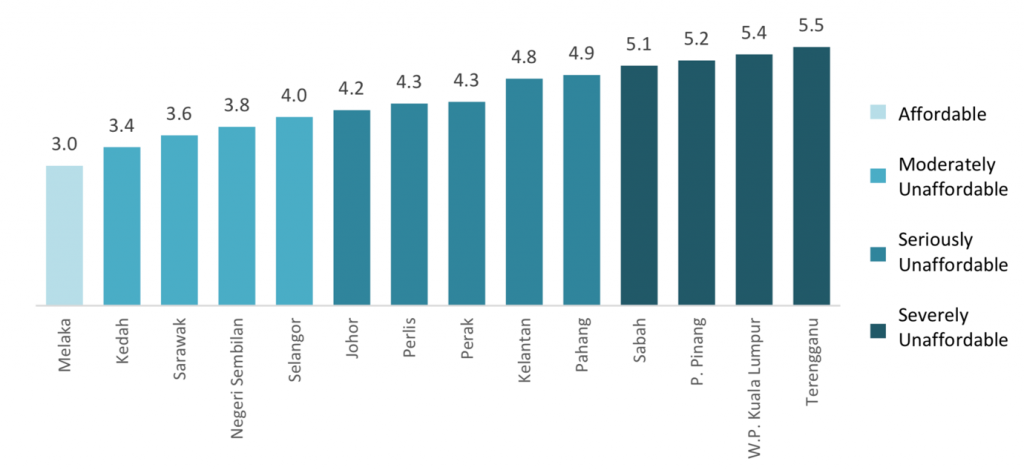

Median multiple affordability by state, Malaysia, 2014

Source: Khazanah Research Institute, 2015

More worryingly, the median multiple ratio for Kuala Lumpur (5.4 times), Penang (5.2 times), Terengganu (5.5 times) and Sabah (5.1 times) are considered to be severely unaffordable, which means affordability of housing in Malaysia still needs improvements when compared to Singapore (4.8 times) where it is only a city state.

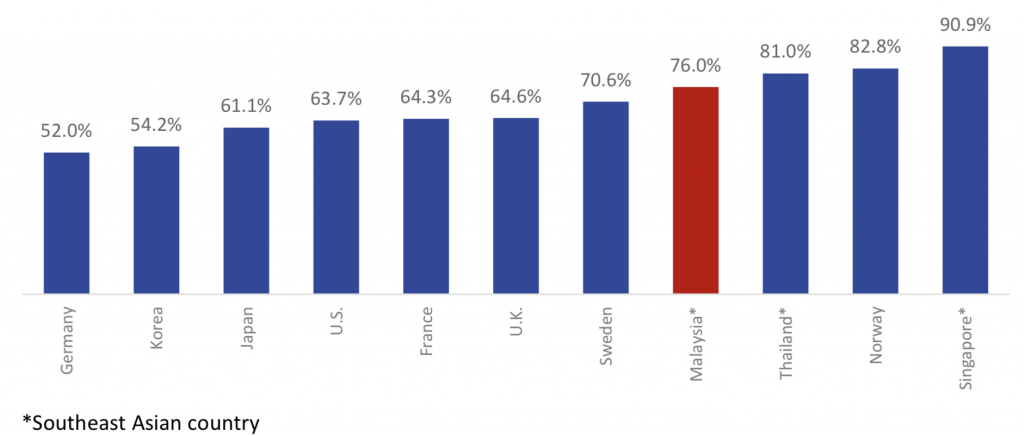

Homeownership rate (%) by country

Sources: (1) Department of Statistics Malaysia, 2014; (2) Department of Statistics Singapore, 2016; (3) 2010 Population and Housing Census, National Statistical Office of Thailand; Data for other countries sourced from The Evolution of Homeownership Rates in Selected OECD Countries: Demographic and Public Policy Influences, OECD, 2011

Malaysia currently has 76% of homeownership rate nationwide as of 2014. In terms of homeownership, Malaysia has it more than majority of developed nations such as the U.S. which has 63.7% homeownership rate, Japan which only has 61.12%, 63.5% in the U.K. and many others as shown in the figure below. This indicates that a large number of households in Malaysia are much able to own a home compared to other countries.

In Southeast Asia, Malaysia homeownerships rate is lower than that of Thailand (82.8%) and Singapore (90.9%). However, higher homeownerships have a dark side to it, especially when housing in the country is seriously unaffordable. Malaysia household debt-to-gross domestic product (GDP) ratio increased to 89.1% as of 2015 from 86.8%, large portions of it coming from mortgage payments and other debts involving residential properties. Moreover, people who cannot find a job near their home, but are tied down by a mortgage usually end up commuting long distances for work and spend large amounts of time in traffic, of which could have been used more productively. Across many economies, homeowners in rural and small town communities generally have higher levels of mortgage-free homeownership than their suburban and urban counterparts. Similarly, in Malaysia, the percentage of home ownership in urban areas is lower than in rural areas.

Comparison of home ownership between urban and rural areas, Malaysia, 2014 Sources: Ministry of Urban Wellbeing, Housing and Local Government (KPKT) Selected Statistics until June 2016